No COE CNY ang pow from LTA for motor traders and new car buyers, with 210 fewer car COEs for the six-bid quota tender period of 2026 February to April

The 2026 Feb-Apr COE quota for car Categories A, B and E combined will be cut by 1.489 percent - from 14,094 to 13,884 certificates.

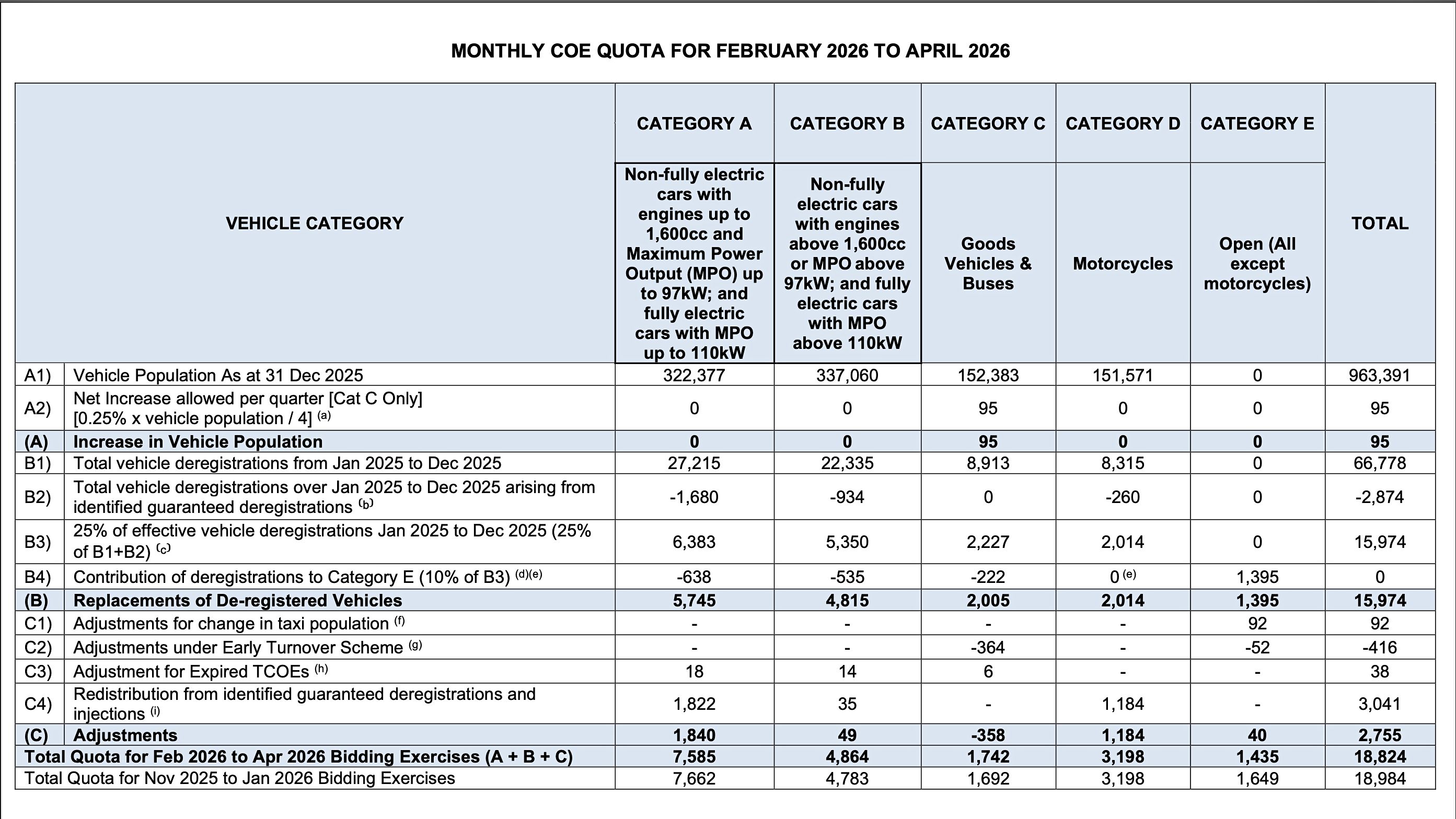

The total certificate of entitlement (COE) quota announced by LTA (Land Transport Authority) for the tender system’s next quarter, 2026 February to April, will be 18,824 - which is an overall reduction of 160 certificates, or 0.84 percent compared to the previous quarter of 2025 November to 2026 January.

LTA headlined its latest quota announcement with “COE supply for Category A expected to remain stable”.

The stability in question, however, might not address the general sentiment among consumers and commenters that the Category A COE, which is originally meant for smaller/cheaper “mass-market” new cars, has been uncomfortably close to the Category B COE, which is for bigger/pricier “upmarket” new cars.

The difference in quota premium between Cat A and Cat B has been as low as a few thousand dollars - $4,999 in the first bidding of 2025 November and $5,601 in the second bidding of 2025 December.

The unshakeable market demand for Cat A COEs is driven by the drastically increased number of models and players (mostly Chinese EV brands) since 2024, with all the popular bodystyles present and provided by go-getting dealerships, which cover the sellable spectrum from BYD to BMW.

In such a situation, a cut in the supply of Cat A COEs would probably stabilise the premium upwards if the demand remains (too) strong. That being said, the reduction in Cat A quota is only 1 percent, with just 77 fewer COEs for Category A in the three-month, six-bid period of 2026 February to April, which equates to about 13 less Cat A COEs per bidding exercise.

If we count COE Categories B and E (Open) as one, because the latter’s certificates of entitlement are almost always “diverted” to register Cat B passenger cars, the percentile reduction in COE quota for Categories B and E combined is twice as much as that for Category A, with a nett drop of 2.06 percent. This means 133 less Cat B/E COEs in total for the three-month period of 2026 February-April, which equates to about 22 less Cat B/E COEs per bidding exercise in the said period.

LTA's three-month, six-bid COE quota calculations for 2026 February to April.

LTA's three-month, six-bid COE quota calculations for 2026 February to April.

Motorist canvassed the Leng Kee neighbourhood for comments from industry insiders about the new COE quota for 2026 February to April.

Vantage Automotive (BYD and DENZA) managing director Anthony Teo said: “I’m a bit disappointed that overall COE was reduced by 1 percent. With the quota reduction in Cat A, its premium will likely remain high as there are more brands offering Cat A cars. Although the Cat B quota increased, Cat E has been reduced, and the nett impact is still a reduction as Cat E is usually used for Cat B cars. Cat B premium will still remain high or drop slightly, depending on market demand.”

Kah Motor (Honda) chief executive Nicholas Wong added: “I think the Government is trying to stabilise COE supply by keeping to zero or slight variations. However, the number of cars reaching 10 years is increasing. If the supply does not match the replacement, then I’m afraid that COE prices will continue to remain high.”

Komoco Motors (Hyundai) commercial director Ng Choon Wee chimed in: “No increase in Cat A and Cat E, the fluctuations are minimum. Cannot stabilise market despite stabilising supply.”

Eurokars (BMW and MINI) managing director Jason Lim said: “It’s quite a surprise that it’s a cut. The industry is expecting an influx of quota, but we’re not really seeing that happening.”

Tan Chong Motor head of Nissan sales & marketing Ron Lim told Motorist: “The big surprise was the cut in Cat A COE quota. LTA did mention during the last quota release that Cat A COE quota was expected to peak in the last quarter (Q4 2025) and the coming quarters, so we were already expecting a minimal increase for Cat A COE quota, but certainly not a cut. Deregistration actually increased but was mitigated by the huge clawback, which the market cannot anticipate the numbers for. I think, quota aside, the market will have to decide whether the current COE premiums are acceptable.”

A senior executive managing a multi-brand business in the Leng Kee motor belt had the last word: “Government needs money?”

Thinking about upgrading your car after seeing the latest COE results? Motorist can help you sell your vehicle at the highest possible price. Simply click on the button below to receive an online car valuation today. This service is completely free, with zero obligations.

Claim your free car valuation today!

For those looking to renew their COE, Motorist also provides free COE renewal advice. That way, you can decide if it's a better option to scrap your vehicle or extend its life.

Here are some other resources that might be of interest:

COE Hike: Car leasing companies not main culprits in rising COE prices

COE Hike: Why Now Is the Best Time to Purchase a Used Car

COE Hike: Why It's A Good Time To Sell Your Current Car Now

Join our COE Live Results & Speculations Telegram Group

Schedule a free COE renewal consultation session!

Download the Motorist App now. Designed by drivers for drivers, this all-in-one app lets you receive the latest traffic updates, gives you access to live traffic cameras, and helps you manage LTA and vehicle matters

Did you know we have a Motorist Telegram Channel? Created exclusively for drivers and car owners in Singapore, you can get instant info about our latest promotions, articles, tips & hacks, or simply chat with the Motorist Team and fellow drivers.