NTUC Income’s New ‘Droplet’ Plan Insures Grab Customers from Surge Prices When it Rains

(Photo Credit: Straits Times)

(Photo Credit: Straits Times)

NTUC Income new insurance plan will protect you, and your wallet, from expensive surge prices when it rains.

Called ‘Droplet’, it is the first ever insurance plan that protects riders against unpredictable surge prices on ride-hailing platforms when it rains.

Announced on Wednesday (24 Oct), it is a move likely triggered by NTUC Income that suggests ride-hailing companies and surge pricing are here to stay. Currently, Droplet only covers Grab rides. NTUC Income said that Droplet will be extended to other ride-hailing platforms by year end.

Surge pricing is the act of ride prices going up in times of high demand. This practice is usually triggered at certain times like rush hour, or even unexpectedly, like when it rains.

Droplet will pay up to 60% of a rider’s trip or cancellation fee if the rider books a ride through a ride-hailing platform while it is raining at their area. To be covered by Droplet, riders must purchase the “reinsurance” at least a day ahead of their rides. The plan must be bought for a coverage of two days minimum.

Droplet’s premiums won’t exceed $9.60 a day. Commuters can submit claims for as many rainy rides they took the day while under coverage, up to a maximum claim cap of $50 a day

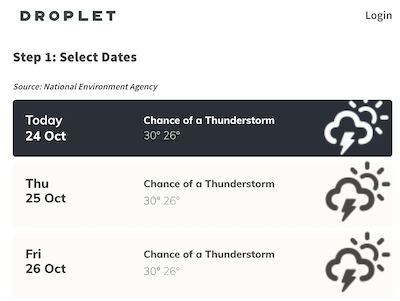

(Screenshot: Droplet)

After we looked into it, we found that buying a two-day plan (25 and 26 Oct) costs $8.70. With a maximum cap of $50 a day and a 60% coverage, Droplet covers customers fares up to a total amount of $83.33 a day.

(Screenshot: Droplet)

To help riders make informed decisions about purchasing Droplet’s plans, real-time weather forecast from the National Environment Agency will be shown on Droplet’s website.

“By offering dynamic premium pricing, consumers can plan for better protection against surge pricing due to rain whenever they hail a ride,” said NTUC Income.

Droplet is part of NTUC Income’s efforts to reimagine insurance, and to provide answers to new pains that consumers face. The insurance company also said that such new pains appear due to technological disruptions.

NTUC Income added, “Droplet is a blue-sky response to consumers’ pain point – surge pricing due to rain – when they book a ride on ride-hailing platforms. In Singapore, where an average of 167 days of rainfall can be expected a year, consumers can now meaningfully address this pain point with insurance cover by Droplet.”

I want to find the most affordable car insurance plan within 24 hours!

Read more: Grab Looks to Improve Passenger Safety with a New Alert System for Drivers

Download the new Motorist app now. Designed by drivers for drivers, this all-in-one app lets you receive the latest traffic updates, gives you access to live traffic cameras, and helps you manage LTA and vehicle matters.

over 7 years ago

over 7 years ago