Renew COE: Everything You Need to Know

(Photo Credit: Business Times)

(Photo Credit: Business Times)

Renewing your COE for the first time? For first-timers, this entire process can be rather tedious and daunting. That is why we've written this handy guide to walk you through it.

Understanding COE Renewal

When your COE expires, you will need to renew it in order to keep the vehicle registered under your name. If the COE is not renewed, your vehicle will be deregistered and will need to be scrapped.

Renewal can be done before your existing COE expires. It can also be done one month after the COE expiry date. However, you won’t be able to drive your vehicle until the COE has been renewed.

In addition, you will also be charged with a late payment fee. Please view the table below to learn more about it.

(Photo Credit: One Motoring)

Kindly note that car owners who fail to renew their COE within one month of their COE expiry will have to scrap their car immediately.

Why should I renew my car’s COE?

The most obvious reason to choose COE renewal is the lower upfront cost. Unlike buying a new vehicle, where you’d have to go through the whole COE bidding process and pay for the full price of the car, it only requires you to pay for the Prevailing Quota Premium (PQP).

The PQP is calculated by taking the moving average of COE prices in the last 3 months. This means that the PQP will change every month.

Should I renew my COE for 5 or 10 years?

If you do decide to renew your COE, you have the option to extend it by five or 10 years. Before making your decision, you should consider how much longer you intend to drive your vehicle.

As highlighted above, you will only need to pay for the PQP when renewing your COE. The PQP payable will be reduced by 50% if you choose to renew your COE for five years.

This is a more viable option if you are not prepared to commit to another 10-year COE cycle. You should also go with a five-year COE if you plan to change your vehicle in the near future.

Do note that you can only renew your COE for five years only once. After those five years, you won’t be able to renew it again and will have to deregister your vehicle.

For 10-year renewal, you can renew it continuously once those 10 years are up.

How do I renew my car’s COE?

There are few ways to do it. Ideally, it should be done at least one month before its expiration.

- By Internet

You can renew your COE via the Internet daily from 6am to midnight. You’ll need an Internet Banking Account with any of the following banks:

- Citibank

- DBS/POSB

- OCBC/Plus!

- Standard Chartered Bank

- UOB

To ensure the successful deduction of the PQP, please ensure there is adequate funds in your bank account. In addition, the payment amount should be set within your daily internet Payment Limit. Your can adjust this amount via your Internet Banking account.

- By Post

If you are renewing your COE by post, you’ll have to do so at least 2 weeks before your expiry date. Your post should include a completed application form and payment.

Your post should also reach LTA before the end of the month that the PQP is applicable. Kindly note that your application date would be the date that LTA received your application. Depending on which is earlier, the PQP payable will be either the application date or the expiry date.

- At the LTA Customer Service Centre

For those paying on or before COE expiry, you can choose to pay by cheque, cash, or cashier’s order. You may also pay the PQP by Diners Club Card or NETS, provided the amount is within the daily transaction limit set by your bank.

If you do pay by cheque, kindly note that your COE will only be renewed upon the clearance of your cheque. If your cheque does not clear, the renewal application will be cancelled, and a S$30 (before GST) administrative fee will be imposed for the cancellation of the application

For renewal after COE expiry (within one month after the expiry date), only cash, cashier’s order or NETS payment will be allowed. You will also need to settle the late payment fee, as highlighted in the point above.

Getting a loan to renew my COE

In case you didn’t know, you can actually take a loan from a financial institution to renew your COE.

Unlike a regular car loan (you can only get a 60 to 70% loan at most), you can get a loan to fully cover your renewal. The loan repayment term differs depending on how long you plan to renew your COE.

If you are renewing for 10 years, the maximum term is 7 years. For 5 years, the maximum term is 5 years.

If you are concern about the interest rates, don’t fret—because we offer a complimentary service to help you find a loan with the lowest interest rates. Simply click on the button below to get started.

Please help me with my COE renewal loan

Anything else I should know about?

- Forfeiting of rebates

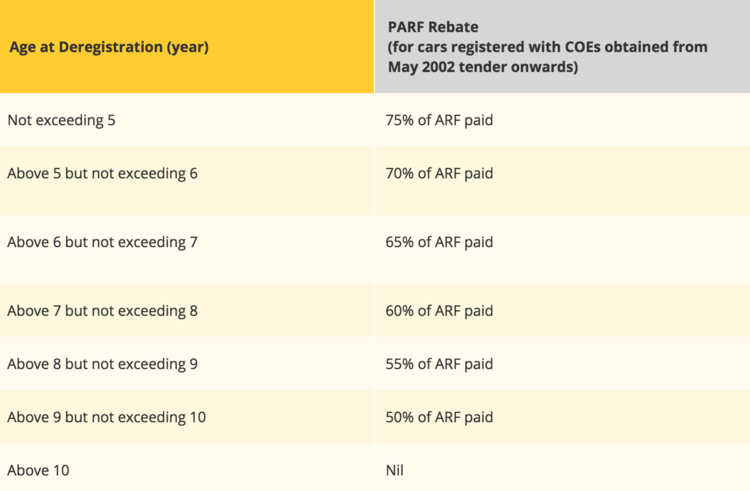

When you renew your COE, you will lose your existing COE and Preferential Additional Registration Fee (PARF) rebates.

Your PARF rebate is calculated based on the age of your car at deregistration. Your vehicle’s PARF value is determined by your Additional Registration Fee (ARF). Here’s a handy chart to calculate how much we’re talking about.

(Photo Credit: One Motoring)

(Photo Credit: One Motoring)

As for the COE rebate, it’s determined by your Quota Premium (QP), pro-rated to the number of months and days remaining on your vehicle’s COE. In case you have forgotten, the QP is the initial amount that you paid when bidding for your COE.

Most car owners will choose to renew their COE closer to the expiry date, or on the day itself. That way, it minimises the loss of this rebate.

The COE rebate is also given to car owners with vehicles above the age of 10. Instead of using the QP, it uses the PQP amount that was paid during the renewal process.

Here’s an example: If your car had its COE renewed for 10 years at $30,000 but was later scrapped at the 5-year mark, you’ll receive $15,000 back as COE rebate upon deregistration. Cool huh?

- Mileage and Wear

Before you decide to invest in another five or 10 years with your car, you have to make sure it can live through those years. You car would undoubtedly have its fair share of wear and tear, and one important indicator would be its mileage.

Singaporean cars usually cover an average of 20,000km per year. At the end of their COE cycle, it should add up to around 200,000km. By then, you probably need to replace certain parts to ensure the smooth running of your vehicle. If these replacements parts are not easily found or are costly, it could be a problem for you as a COE car owner.

- Higher road tax

One downside of renewing COE is the higher road tax. Car owners who possess vehicles that are 10 years and old will be subjected to a road tax surcharge. The surcharge is calculated as follows:

(Photo Credit: LTA)

- Lower depreciation for COE renewed cars

Vehicle depreciation can be rather difficult to explain; therefore, we’ve put together the following table to help you better visualize it.

Let's assume both vehicles are of the same price, make and model. For the COE and PQP values, we’ll use August 2018 COE bidding results as reference.

|

New Car |

Car with COE Renewed |

|

|

Car Purchase (Market value + AF + ARF) |

$70,000 |

Not applicable since the car has already been paid for |

|

COE price for Cat A vehicle (Quota Premium) |

$31,997 |

Not applicable because you don’t have to purchase a new COE |

|

PQP |

N/A |

$34,197 (The amount that you pay when renewing your car’s COE) |

|

PARF Rebate (Scrap value) |

Less: $6,500 (The PARF rebate is taken off because you’ll get back this amount if you decide to scrap your car) |

Add: $6,500 (PARF rebate is added because you’ll be giving up this amount when you renew your COE) |

|

Years |

10 |

10 |

|

Annual Depreciation |

$9,549.70 |

$4,069.70 |

As you can see, the annual depreciation for a new car is significantly higher than a COE car. The reason mostly comes from the total cost of the new vehicle, which includes the purchase price of the car and the COE bidding.

For a COE car, those amounts are not applicable because they have already been paid for. Only the PQP and PARF rebate that was given up will be calculated for annual depreciation.

Receive free COE renewal advice from Motorist.sg

Motorist.sg offers free consultation on the pros and cons of renewing your COE vs scrapping your expiring car.

If you do decide to renew your COE, we can also assist you with the renewal process, including sourcing for the lowest interest loan rates, applying for the renewal loan and settlement of all the paperwork.

To find out more, simply fill in your particulars in the form below.

Schedule a free COE renewal consultation session!

Read more: 4 Questions to Ask Yourself Before Renewing the COE of Your Car

Download the new Motorist app now. Designed by drivers for drivers, this all-in-one app lets you receive the latest traffic updates, gives you access to live traffic cameras, and helps you manage LTA and vehicle matters.

over 4 years ago

over 8 years ago

over 8 years ago

over 8 years ago