MAS Eases Car Loans: The Good and the Bad

(Photo Credit: TODAY Online)

(Photo Credit: TODAY Online)

Rejoice, car-buying folks! Now, you get more money and time out of your car loans.

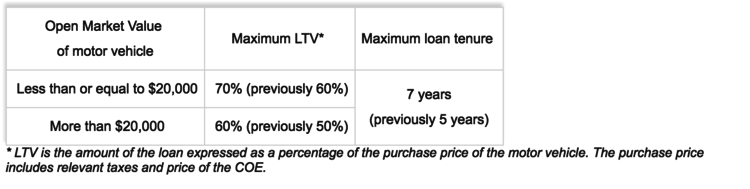

Back in the dark days of 2013, you'd only get to borrow 60% of the purchase price if your car's Open Market Value (OMV) was $20,000 or less for a period of five years. If your car's OMV was above $20,000, the banks would loan you a maximum of 50% of the car's purchase price for five years.

Now, MAS has finally eased their clamps. Take a look!

(Photo Credit: MAS)

(Photo Credit: MAS)

What this seemingly minute increase means is that you've got a couple more options with the same money. Before MAS eased up on the laws, getting a typical Toyota Corolla Altis was a little tougher. With COE, the car fetches $117,888 today, and has an OMV of $17,660. Assuming interest rates are at 2.78%, what you would've needed back then was $47,155 as down payment. As for your loan, you'd have to manage paying $1343 a month for five years.

With the new implement, getting an Altis means that the down payment stands at $35366- that's $11789 less that you have to fork out! Besides that, your monthly loan repayment drops to $1,174.

Of course, more options beg the question- what are the downsides? Then... what do you do next?

More breathing space for a price

This one is a given. A considerably lesser down payment, lower monthly payments and a longer time to fork out the cash offer you much more space to breathe. It's important to note that interests stack on per annum, so this luxury won't come unpaid.

Let's use the Toyota Corolla Altis as an example. In the situation of a 5-year tenure, you have to have more money at hand for the down payment and to pay off more per month. However, you'd be paying a total of about $127720 at the end of the day.

With a seven-year tenure, the price increases to nearly $134,000! That's roughly a $6000 difference, or as it is more commonly known, the "sssss ouch". If you can afford a high down payment and monthly payment, it saves you more in the long run to borrow lesser and go for a shorter tenure. If you need the luxury of time, weigh out what's comfortable for you and how much you're paying at the end!

COE hikes and used cars

As MAS Deputy Managing Director Ong Chong Tee said: "In 2013, when we introduced the measures, our immediate aim was to help restrain escalating COE premiums and consequent inflationary pressures." Now that the measures are a little more relaxed, you may face a problem.

With more people having the means and ways to buy a car, some speculate that it would drive COE prices up. We're not clairvoyants to say for sure, but opting to go for a used car instead could help avoid this ordeal altogether!

I want to find the most affordable car insurance plan within 24 hours!

Read more: New Car VS Used Car: Which is Right for You?

Download the new Motorist app now. Designed by drivers for drivers, this all-in-one app lets you receive the latest traffic updates, gives you access to live traffic cameras, and helps you manage LTA and vehicle matters. Download it now and stand a chance to win $1,000 worth of petrol vouchers monthly.